how much taxes are taken out of a paycheck in ky

In this case KY taxes should be withheld from his pay. 103 KAR 18150 To register and file online please visit wrapskygov.

Paycheck Calculator Kentucky Ky Hourly Salary

FICA Taxes of employee gross pay Employee Pays.

. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. If you have your savings in a typical retirement account such as an IRA or a 401k you can benefit from the deferral of taxes on any income you earn within the accounts. Kentucky Hourly Paycheck Calculator.

If youre an employee this is accomplished by your employer who withholds your income and Social Security and Medicare taxes from your paychecks and sends the money to the IRS. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks. 145 145 Additional Medicare Tax 09 on gross pay over 200000.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. For any wages above 200000 there is an Additional Medicare Tax of 09 which brings the rate. For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Kentucky residents only. Employers also have to pay a matching 62 tax up to the wage limit. A 2020 or later W4 is required for all new employees.

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Kentucky paycheck calculator. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax.

The state of Kentucky uses a graduated income tax schedule much the same way the federal government does. Posted by 5 years ago. For members who have made taxed contributions to KPPA and elect to receive monthly benefits current Internal Revenue Service regulations provide that the amount of after-tax dollars in the account be recovered by making a portion of each monthly benefit non-taxable.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. Its important to note that there are limits to the pre-tax contribution amounts. Unfortunately the deferral is not infinite and you must pay taxes when you.

This Kentucky hourly paycheck calculator is perfect for those who are paid on an hourly basis. Amount taken out of an average biweekly paycheck. Kentucky Salary Paycheck Calculator.

This is because they have too much tax withheld from their paychecks. It is not a substitute for the advice of an accountant or other tax professional. The average taxpayer gets a tax refund of about 2800 every year.

Social Security Tax 124 up to annual maximum 62 62 Medicare Tax 29 up to 200000. The taxes that are taken into account in the calculation consist of your Federal Tax Kentucky State Tax Social Security and Medicare costs that you will be paying when earning 3000000. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Our Kentucky State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 3000000 and. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks.

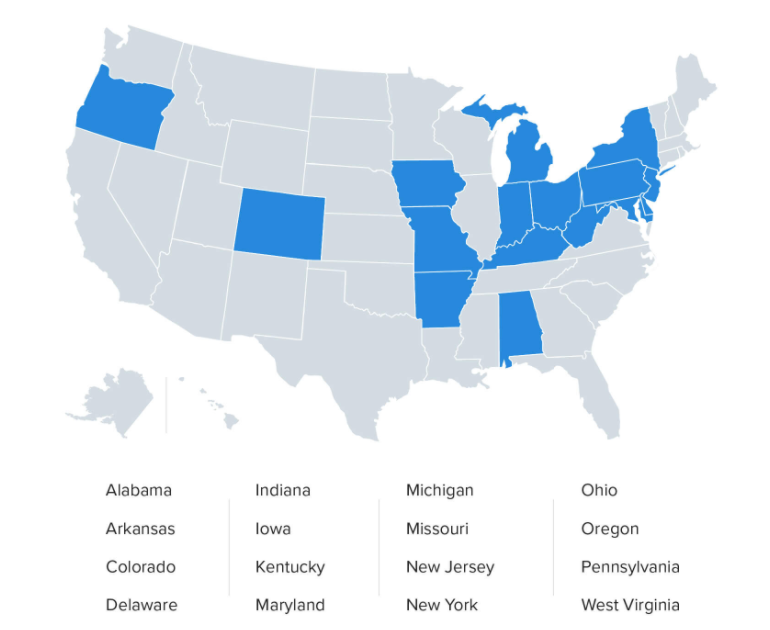

Effective May 5 2020 Kentuckys tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods beginning on or after January 1 2021. Social Security tax which is 62 of each employees taxable wages up until they reach 147000 for the year. Taxes Federal Income Tax.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Switch to Kentucky hourly calculator. In the second case where the person both.

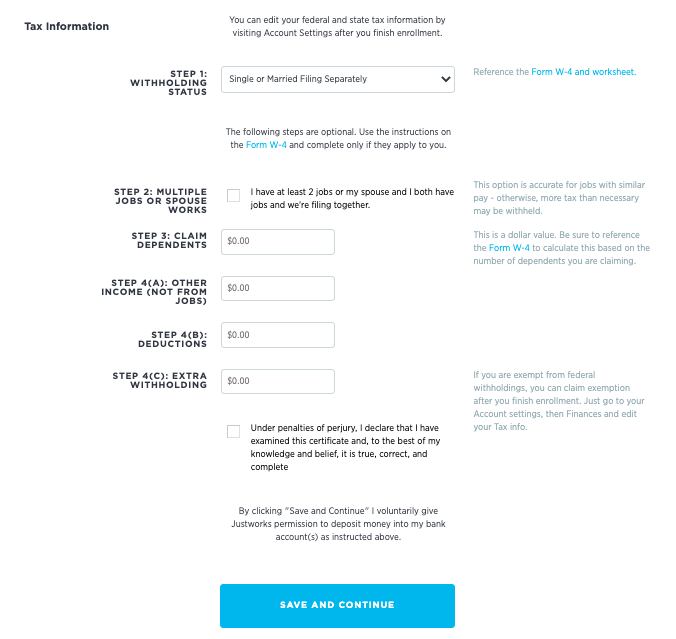

Total income taxes paid. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. 10 rows To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and.

Both employers and employees are responsible for payroll taxes. For 2022 the limit for 401 k plans is 20500. For instance workers who make 3000 a year or less in taxable income pay state taxes at a rate of 2 percent while those who earn between.

So to take the first case in our scenario the person who lives in Tennessee but works in Kentucky does have to pay Kentucky taxes. Monthly benefits from KERS CERS and SPRS are subject to federal income tax. Total income taxes paid.

Hes considered a nonresident so he only has to pay KY taxes on the money that he earns while physically in KY. Workers at the lowest end of the economic scale pay a lesser percentage of their income in taxes than those who earn more. Medicare tax which is 145 of each employees taxable wages up to 200000 for the year.

If you increase your contributions your paychecks will get smaller.

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Kentucky Income Tax Calculator Smartasset

The Kentucky Income Tax Rate Is 5 Learn How Much You Will Pay On Your Earnings

Payroll Software Solution For Kentucky Small Business

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

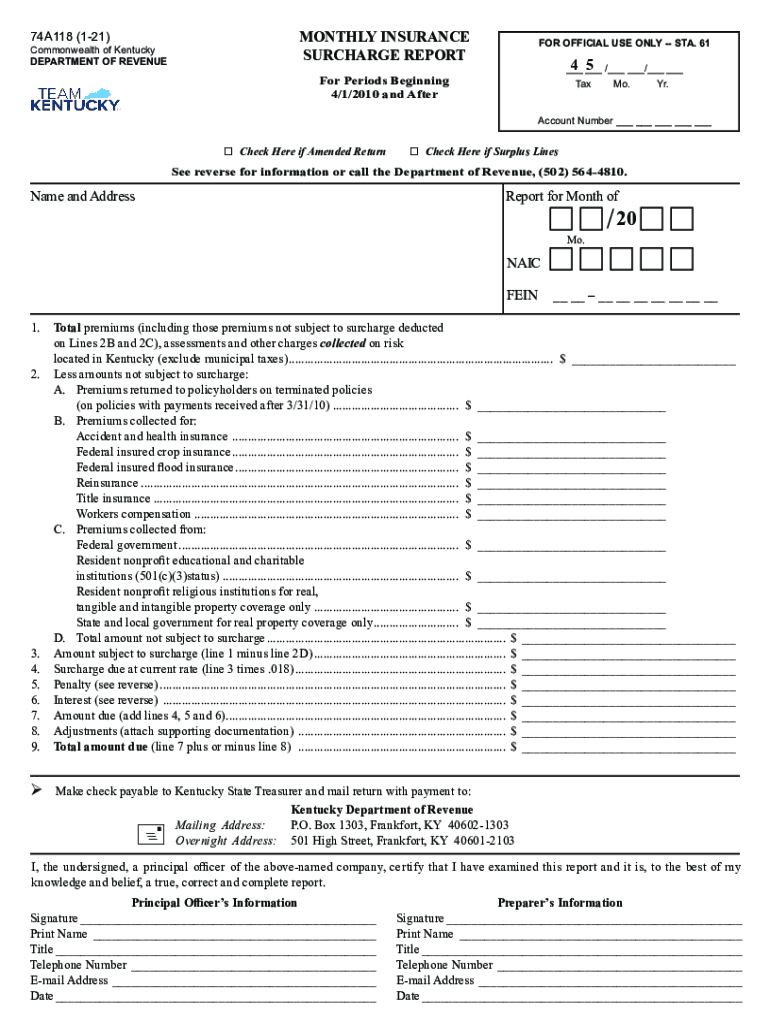

Ky 74a118 2021 2022 Fill Out Tax Template Online Us Legal Forms

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Payroll Software Solution For Kentucky Small Business

Kentucky Paycheck Calculator Smartasset

Questions About My Paycheck Justworks Help Center

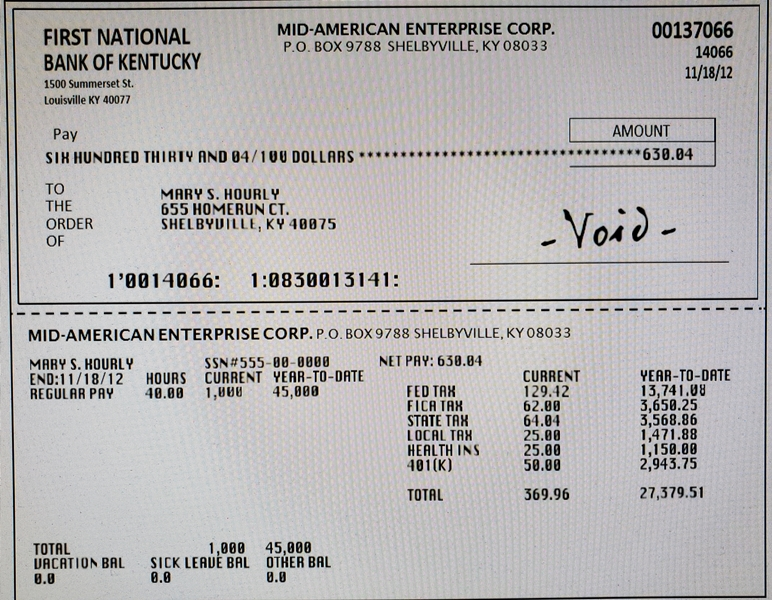

Solved Look At The Check Below And Answer The Following Chegg Com

Fireman Salary In Louisville Ky Comparably

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Free Online Paycheck Calculator Calculate Take Home Pay 2022

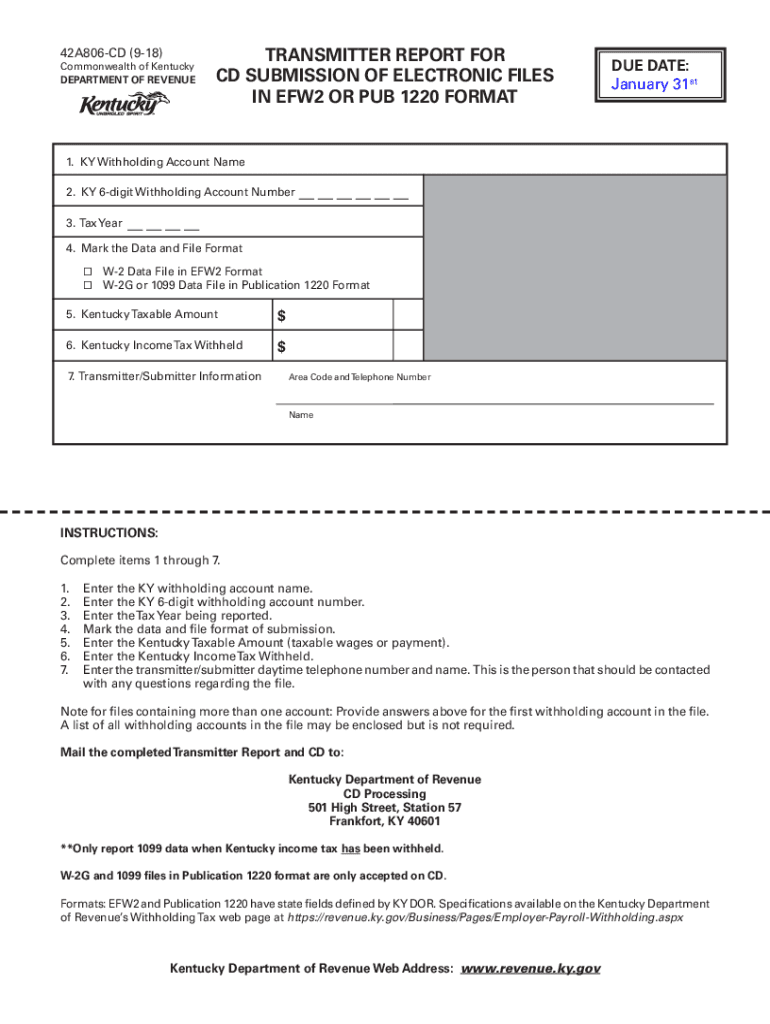

Ky Dor 42a806 2018 2022 Fill Out Tax Template Online Us Legal Forms

Peoplesoft Payroll For North America 9 1 Peoplebook

Tax Withholding For Pensions And Social Security Sensible Money

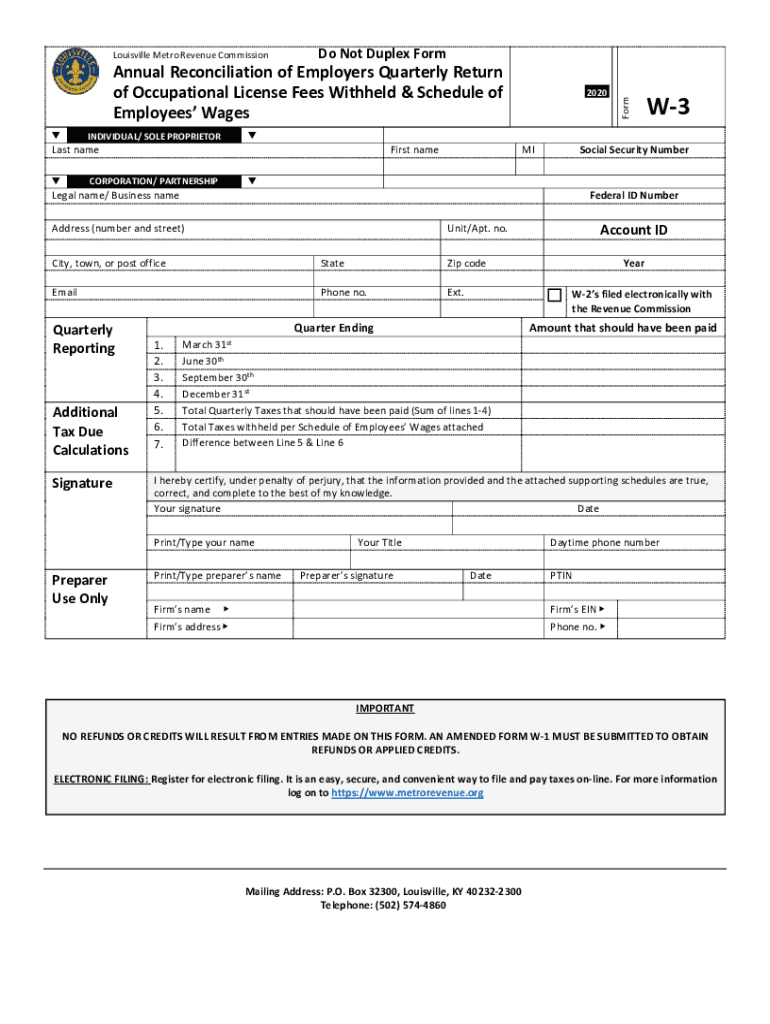

Ky W 3 Louisville 2020 2022 Fill Out Tax Template Online Us Legal Forms